Students stress about cost of senior year

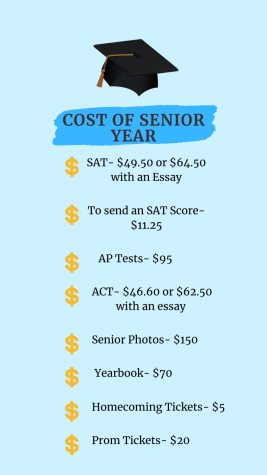

Students spend a lot of money throughout their schooling to participate in activities and go to college. The above photo represents some of those costs.

Public education is free, right? Not exactly. The local taxpayer provides the funding for the education itself, but there are a multitude of items and events that students must pay for- particularly seniors. This is included but not limited to college applications, standardized tests, senior portraits, yearbooks, homecoming and prom.

“I feel like the cost of all these things are not considered for students and families who can’t afford it,” an anonymous low-income student said.

Not every senior buys a yearbook or attends a school dance or applies to college, but many seniors do. According to the US Bureau of Labor Statistics, 66.2 percent of high school graduates from 2019 were enrolled in a college.

“Even though my family can afford college applications and everything that comes with it, it still costs a lot of money, and I can’t even begin to imagine the stress that that might put on a lower income family,” senior Alex Thaler said.

Many students will apply to multiple colleges and take multiple standardized tests, especially AP students. Because of these costs and others like it, some students with lower income families are upset by these costs. The below graphic illustrates some of the costs of senior year.

“It is frustrating that it costs so much money to not only apply to colleges, but to also take the standardized tests. I could only afford to take the SAT once, and I had to make sure to really study because I couldn’t afford to take it a second time like many other students seem to. $60 for a shirt versus $60 for a college application or two, I would rather spend that money on applying to college,” the anonymous student said.

Some students try to alleviate the cost of senior year by holding a job.

“Having a job has definitely helped alleviate the stress of the cost of senior year. I make sure to budget myself and never spend more money than I make so that I can save for college. It can be very stressful at times- having to juggle school and work,” Thaler said.

Other students have more difficulty budgeting their money.

“I don’t get scheduled for many hours, even though I try to cover as many shifts as I can, so I get less than $200 per paycheck. Budgeting that money into gas and car insurance and my phone bill, there isn’t a lot left for me to save, but I try,” senior Makayla Murphy said.

Another expensive item associated with senior year are yearbooks or senior portraits. The yearbook starts off at $60, but the price only rises as the year goes on.

“I’ve wanted a yearbook every year, but it was just never in the budget, even if we bought it at the beginning of the year. Luckily, it is in the budget this year, but yearbooks last forever and can be a great reminder of what times were like,” the anonymous student said.

While the price of senior portraits can range from being free to upwards of $500, the average price for a session is $150, a price that many students cannot afford.

“I’m not getting senior pictures taken. I would like to, but it was either some pictures or applying to a couple of colleges,” the anonymous student said.

Other students have found ways of getting free or cheap pictures taken.

“When I was a senior, one of my friends had a camera and offered to take some pictures of me. I think that the school also offered a free session on bridge, so there are definitely ways of getting cheap senior pictures,” 2019 graduate Iris Kauffman said.

In regards to senior traditions, some students who cannot buy yearbooks or afford the expenses of homecoming or prom feel excluded from the fun of senior year.

“Although I don’t have to go to homecoming or prom, they are events and moments that are built up in almost every high school movie and I would rather not miss out on them, although Miss Rona might’ve taken care of that for me. While this isn’t that big of a deal for me, I’m sure that other students who are in a similar financial situation as me, but are much more involved in the school would feel a lot worse. If all of your friends have it, but you don’t you’d feel excluded too,” the anonymous student said.

Hey there stranger! My name is Sonia Yost, and this will be my third year writing for the newspaper. Last year I was an associate editor, and I'm thrilled...

Travis Wolfe • Dec 4, 2020 at 7:31 am

the cost of the senior year is outrageous and who can afford from $447.35 – $487.25 for their senior year.